Cash Advance Debt

Is A Slippery Slope.

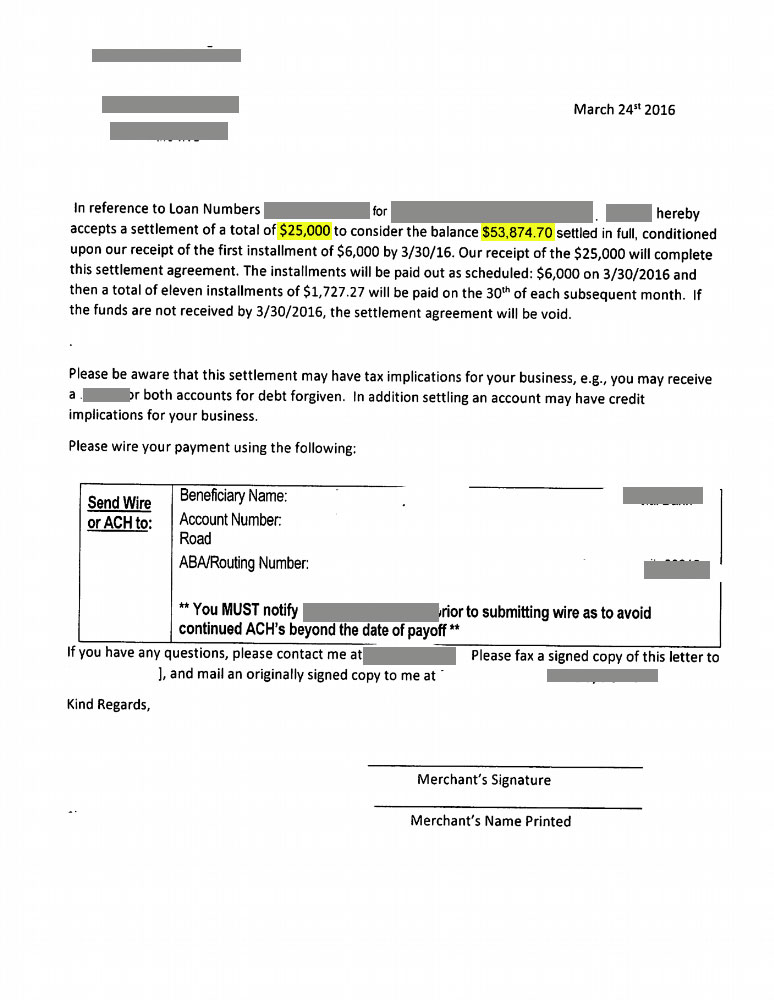

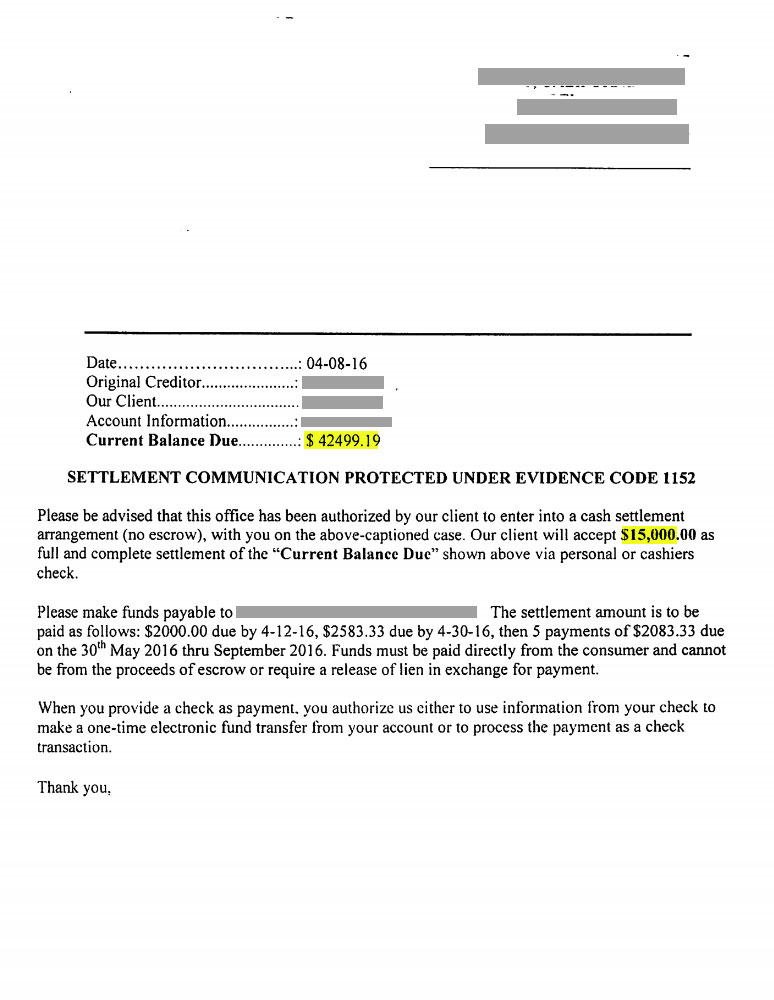

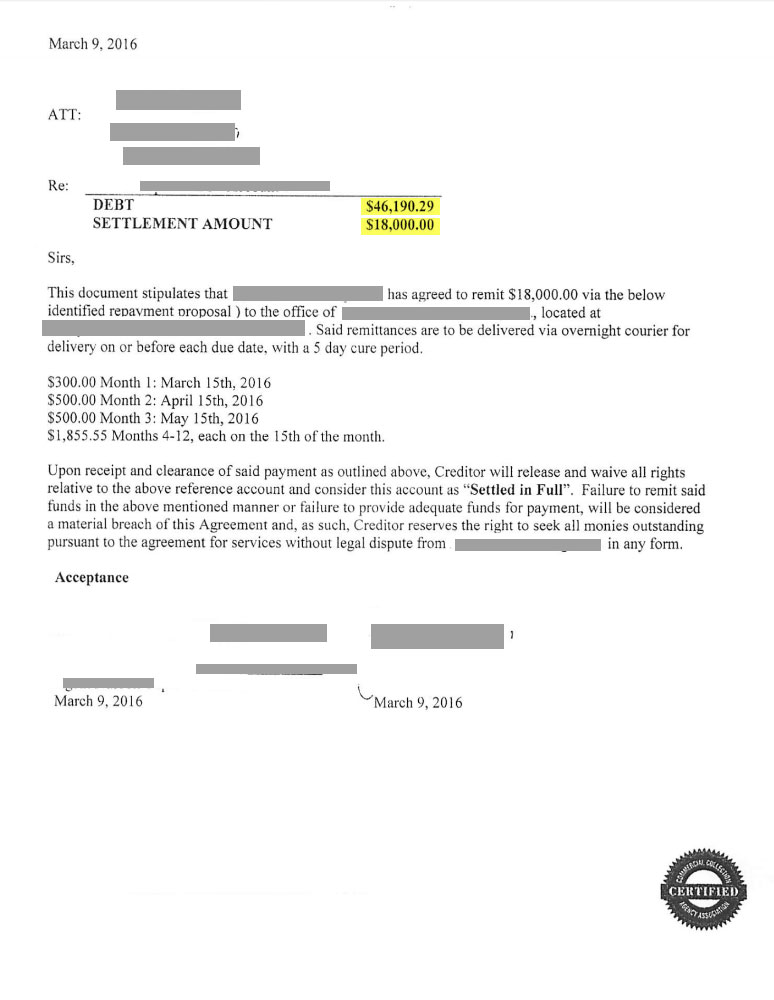

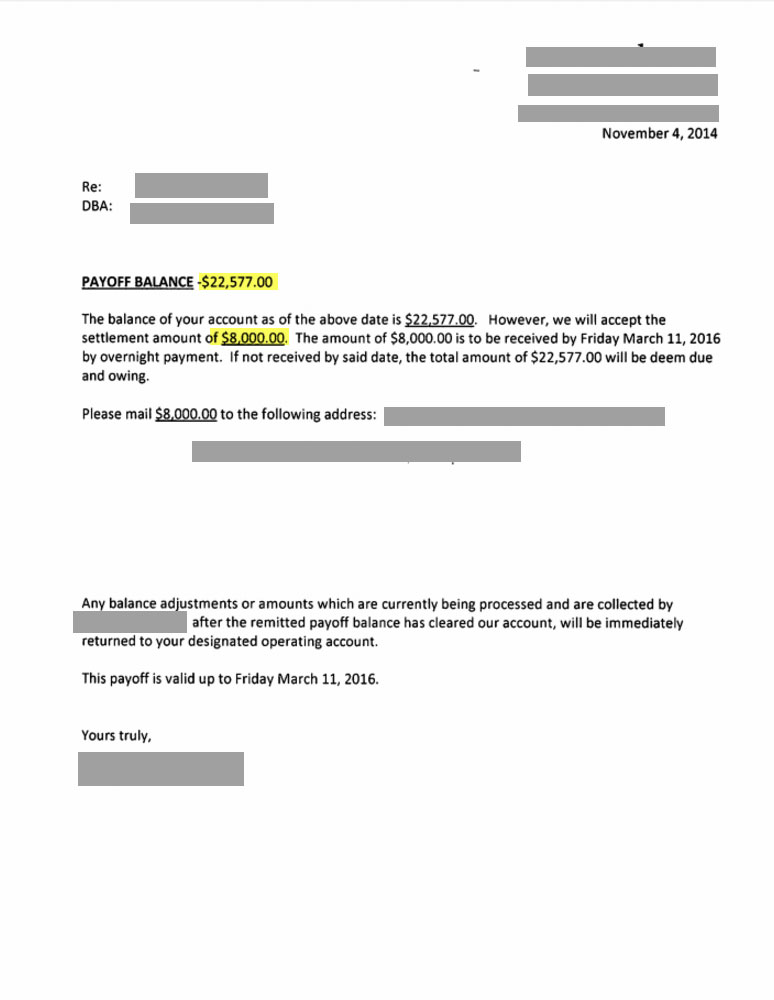

You might be able to reduce your payments by as much as 70%.

Pay Less Than You Owe

We restructure business debt giving you better terms and in most cases a reduction of principal and interest.

Fast Relief

Get back on track within a matter of days.

Flexible For YOU!

You pay off your debt on terms you can afford.

How it Works

We make this process as easy as possible for you. Follow the 3 steps below to get started today

The Problem with Cash Advances

Cash advances can be a lifesaver to a business owner who needs money fast, but they also can turn into a vicious downward spiral of debt if an entrepreneur isn’t careful. Many entrepreneurs find that their companies become dependent on these advances in order to make ends meet. The allure of fast cash, and the need for working capital often brings them to take out bigger and bigger advances. Before you know it, cash advance payments can quickly eat up most, if not all, of a business’s profit. Sadly, many businesses fall into this trap and shutter their doors because of it.

Do you qualify for our help?

If you currently have any of these signs, you’re at risk of business bankruptcy.

- You’re having difficulty paying off cash advance installments

- The debt you’ve taken on is clearly unmanageable

- You’re getting collections calls.

- You no longer can afford your equipment leases or secured loans

- Revenue isn’t as high as you’d hoped, and cash advance payments are eating up most of it

- You’ve begun to slip behind on bills

- You’re using your own credit cards to fund your business

- You no longer make enough to have your own salary

Ask for help before it’s too late

If Your Company Is Drowning In Debt,

Let Us Be Your Lifesaver

Business debt is no laughing matter. We can help you get out of debt before it’s too late.

ABOUT US

Who We Are

Our company has been in business since 2011 and is owned and operated by seasoned debt relief professionals. With more than 2 decades of combined experience we have been able to resolve more than 50 million in troublesome debt. Call today to explore your options!

The Solution We Offer

We are here to help you. We also understand how important it is to help business owners in their time of need. After all, without business, there won’t be any jobs. We work on your behalf with your lenders and vendors to lower your payments, restructure your debt, and keep your business alive and thriving.

What You Get

Choosing our company means you get…

- Fast, confidential debt relief help

- Resources you can count on

- A customized action plan for your company

- Increased monthly cash flow

- One monthly payment amount

- Reduced calls from collections agents

- Help, advice, and encouragement every step of the way

Frequently Asked Questions

We start working by doing a telephone consultation to find out more about your business and the hardship you’re facing. During this consultation, we formulate a budget for you to follow, and work to protect your assets. We then figure out which debts we can assist with and how to handle them. Each debt then gets its own unique plan. Some are restructured and resolved outright, while others will need to get paid off with a payment plan and some may not need to be paid at all.

We communicate with creditors on your behalf, and report the progress back to you. Our goal is to get you a low monthly payout until your debt is resolved and your business is back in the black.

Once we are hired we reach out to them and advise them that we are working on your behalf and to direct all future communications to us. Which means that they won’t need to call you up to ask for payments.

All our work is 100% confidential. We don’t share your information with 3rd parties that aren’t involved in the collections process, and we definitely will not make it public that your company applied for debt relief.

The vast majority of people who approach us ask for debt relief related to cash advances. However, in many circumstances, we will be able to work with other forms of business debt.

Our client liaisons are here to answer any of your questions by phone, mail, or email or visit to our office. You will receive a copy of every written agreement made between us and your creditors.

It depends on how much you are able to put aside, what your cash flow looks like, and how much debt you’ve accrued. More often than not, we can give you an estimate during an initial consultation.

We hate to say it, but not every business will be able to recover from their debt, nor are all businesses able to qualify for our program. People who are most likely to qualify are small to medium sized businesses – especially those that have been around for years. The longer you wait to resolve your debt, the less likely it is that you will actually get the debt relief you want, so call us today.

A common reason for business failure is heavy business debt, especially debt from cash advances. If you currently have any of these signs, you’re at risk of business bankruptcy.

- You’re having difficulty paying off cash advance installments

- The debt you’ve taken on is clearly unmanageable

- You’re getting collections calls

- You no longer can afford your equipment leases or secured loans

- Revenue isn’t as high as you’d hoped, and cash advance payments are eating up most of it

- You’ve begun to slip behind on bills

- You’re using your own credit cards to fund your business

- You no longer make enough to have your own salary

Ask for help before it’s too late.

Latest News

Look through the blog and follow the latest news

Contact Us

Do you need to contact us, or maybe you want to leave feedback?

Call or visit us

- 1.877.300.0702

- info@mycustomerservices.com

- 9:00AM - 5:00PM

- 4400 Route 9 South, Ste 2100, Freehold NJ 07728, USA